Run On Banks, Buy Gold Part II

It looks like the Indymac seizure by the FDIC has caused bank runs across the country. I am not sure if there are runs on deposits, but I’m sure deposit holders and shareholders do not want to be holding the bag on the next Indymac.

So the federal government gave unprecedented assistance to Fannie Mae and Freddie Mac. They opened the discount window, agreed to extend a credit line and also even buy equity in the companies if need be. How did the market react? They took it down and beat it down further.

Self-fulfilling prophecy is the name of the game. When everyone thinks a bank is going bankrupt, everyone sells the stock and pulls deposits out, they do end up going bankrupt. The banks that are most likely doomed are FirstFed Financial of California, Downey Savings of California, Corus Bankshares of Illinois, BankUnited Financial of Florida, BankAtlantic of Florida, Sterling Financial of Washington and Provident Financial of California. These banks are too small for the federal government to bother save and won’t mind them becoming the next Indymac. If you own their stock or have more than the FDIC limits in those banks, it’s still not too late to bail.

The “too big to fail but doesn’t mean stock won’t fail” banks include Washington Mutual, National City, Regions Financial, Marshall & Ilsey and Wachovia. These banks are in serious trouble, but I don’t think it’ll result in a FDIC takeover.

Well I can list every financial stock in wallstreet and they are all in trouble. If you have every bank and brokerage in the country teetering on possible failure…what does this mean? FDIC and the US Treasury doesn’t have enough money to bailout everyone.

So what will we have? We will have anywhere between 50-100 banks fail in the next year. Lehman Bros may be taken under by Goldman Sachs or JP Morgan. Citigroup and AIG may have to break up into little pieces to survive.

I already described before that the Pension and Deficit issues plaguing the United States and Europe will be serious issues that will plague both the Dollar and the Euro. Japan and their Yen has had this problem for nearly 20 years now and there is no end in sight. Emerging Markets and their currencies with 10% annual inflation is plain scary.

So how can you invest your money? You can take a shot through puts on an implosion of a bank, brokerage, insurance company, etc. So far nobody has lost money shorting regional banks and there are many that will likely go down further and implode. But that’s not a viable long-term investment and is just a speculative trade.

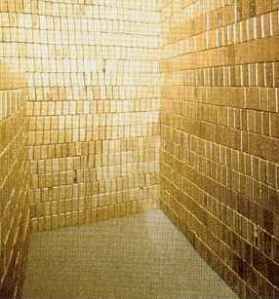

The best way to play this environment is Gold. As people continue to flee the dollar, the euro, the yen, the loonie and all world currencies plagued by pension issues, deficits and inflation…Gold is the currency that everyone wants. I think you play gold by owning GLD (the iShares Gold Bullion Trust ETF) and the GDX (MarketVectors Gold Miners ETF). I would avoid oil but own Natural Gas instead. Natural Gas generally follows oil, is easier and cheaper to find and is currently undervalued compared to oil. Easiest way to own Natural Gas is via the UNG (US Natural Gas Trust ETF) and CHK (Chesapeake Energy).

Stocks in the Ag space like Potash, Monsanto and Agrium are too volatile and their charts look exactly like how Yahoo was in the late 90s. Solar stocks have 50% quarterly moves and are not for any moderate investor.

So stick with Gold, stick with Natural Gas, avoid Financials and avoid any strong dollar dependent stocks (retailers, food producers, automakers, airlines, transports) and you can ride this out.

And for those who think Obama will save us from this mess…there really isn’t anything he can do. The energy and financial crisis created by Bush with the Iraq War on the side is too great for anyone to solve, without declaring a dictatorship or something.

Explore posts in the same categories: Bush, california, conservative, Current Events, federal reserve, Finances, Global Warming, Government, liberal, mad money, mortgage, mutual funds, natural gas, Politics, presidential election, solar, stocksTags: Bush, fannie mae, financials, freddie mac, gold, natural gas, obama, oil

You can comment below, or link to this permanent URL from your own site.

Leave a comment