The Socialists in the House lead by Pelosi wanted little infrastructure building, giveaways to illegal immigrants, labor unions and give tax breaks to people who don’t pay taxes. It is a sham bill that will worsen our recession and will simply reward bad behavior.

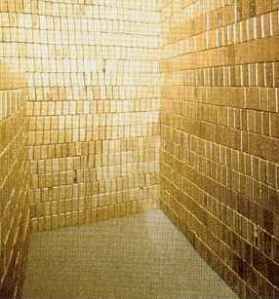

The Senate seems to be getting it and understand that we need more infrastrcuture spending, more help to homeowners and targeted tax cuts that can stimulate the economy. Giving tax breaks to rich individuals, capital gains tax breaks and more write-offs won’t help either. The rich keep hoarding cash or blow it in bad investments with likes of Madoff or end up in costly divorces where the newly minted divorcee wife starts hoarding diamonds, silicone and gold. Giving money to the poor will only help out taco bell, state lotteries and anheuser-busch and maybe help out more mothers wanting to pop out octuplets. And you can’t keep extending unemployment benefits forever. We definitely need a health insurance reform, but that’s for a discussion at another time.

The US is home to one of the highest corporate tax rates in the world. Lowering the corporate tax rate to 25% will entice cash-rich companies like energy, pharmaceuticals and telecom to spend. Also giving an amnesty rate of 5-10% for foreign repatriated earnings would bring in lots of new capital to the country. We’re not rewarding the bad players…because the bad players (banks, finance companies) have huge losses and aren’t paying taxes anyways. We should be rewarding the good and profitable companies and giving them a good environment to invest.

We also need an Eisenhower Interstate Highway Bill II. Most of the freeways we drive on are 40-50 years old. We need a commitment from the federal govt for massive spending on highways…and that will create and maintain jobs that can’t be exported to China. Also while housing prices are depressed, it’s a great time to start using imminent domain to condemn homes and reduce the supply on the market. Expanding the 101, 405 and 5 freeways and completing the 710 will require lots of homes to be torn down and isn’t this a great time to do it? In addition to highways…Let’s build a levee that can withstand a Category 5 hurricane in New Orleans, Let’s finish the incomplete subway system in New York and let’s rebuild our passenger railway system so we can rival what they have in Europe.

We need to bring private capital back into illiquid securities which would help eventually homeowners. An ad-hoc approach to bailout individual homeowners will not work. The government needs to become a market maker or “bad bank” in mortgage backed securities and be willing to continue to buy from and sell to private investors. Initially they would need to pay above market value for the securities and perhaps take some losses, but by calming the markets and by putting liquid high yielding securities on the market (during times where money funds are yielding 0%) we can bring in tons of private capital and allow banks to remove these assets from their balance sheet…or at least be able to mark-to-mark it fairly, to stem the massive write-downs. This does not require nationalization of the banks and will eventually allow the federal govt to get out. Hank Paulson’s TARP capital injections nationalized the banks, which devastated the equity shareholders…and if you keep scaring away private investors, you can’t have a sustained recovery.

By keeping the market for mortgage securities flowing, that will keep interest rates low, and make credit available to those seeking to buy homes, which will in turn stop housing prices from plummeting which in turn will stimulate the economy.

Also tax credits to new car buyers ($1000 to all new car buyers, $2000 for buying hybrids) will be highly stimulative and if matched by the states with sales tax waivers…I think we can help break the death spiral of the auto industry while they wind down.

If we’re spending 800 billion dollars, let’s do it right. Breaking the down cycle is what we must do and we must plant the seeds for a sustainable recovery without becoming socialists.